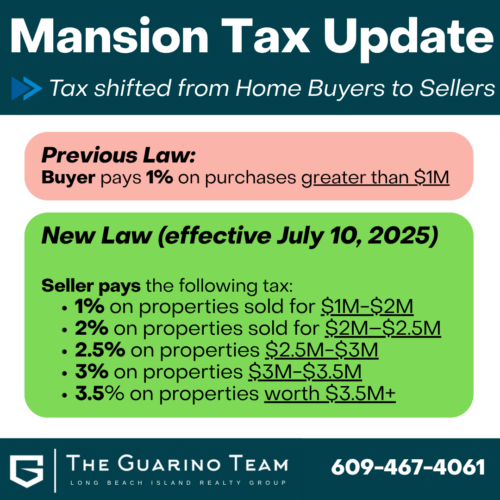

The Previous Law (Before July 10, 2025)

Under the prior law:

- Who paid it: The buyer

- Tax rate: A flat 1% on residential, co-op, farm, and certain commercial (Class 4A) properties sold for $1 million or more

- Also applied to: Controlling interest transfers of commercial real estate worth $1 million+

This system placed the burden entirely on the buyer and had been in place for years without change.

The New Law (Effective July 10, 2025)

Signed as part of the 2025 New Jersey state budget, the new mansion tax law shifts both who pays and how much is paid, based on the sale price:

| Sale Price | New Mansion Tax (Now paid by the Seller) |

|---|---|

| $1M – $2M | 1.0% |

| $2M – $2.5M | 2.0% |

| $2.5M – $3M | 2.5% |

| $3M – $3.5M | 3.0% |

| Over $3.5M | 3.5% |

This structure now places the tax burden entirely on the seller and scales it up based on price tiers. It applies to the same categories of property as before.

Transition Relief: In-Progress Deals

Sellers with contracts executed before July 10, 2025, and closed on or before November 15, 2025, may be eligible for a refund of any amount paid above the previous 1% rate.

To apply:

- Submit Form RTF-3 to the state

- Include the recorded deed, signed contract, and settlement statement

- Submit within 12 months of closing

How This Impacts the Market

Sellers

Sellers now face a significantly higher cost at closing. The impact on net proceeds is substantial—especially for properties in the $2–4 million range. Many sellers may respond by:

- Increasing asking prices to account for the new tax

- Becoming less flexible during negotiations

- Limiting concessions like repair credits or price reductions

Buyers

Buyers no longer pay the 1% tax at closing, which slightly reduces upfront costs. However, this does not necessarily create leverage. In fact:

- Sellers may hold firm on pricing to absorb their new tax obligation

- Buyers should expect fewer price drops or incentives

Key Takeaways

- The mansion tax now affects sellers, not buyers.

- Higher-value sales face steep new tax brackets up to 3.5%.

- Closing before November 15, 2025, on pre–July 10 contracts could trigger a refund.

- Pricing and negotiation dynamics have shifted—but not in favor of one party across the board.

Final Thought

If you’re buying or selling a home in New Jersey above the $1 million mark, make sure you understand how these tax changes affect your bottom line. Timing and preparation are more important than ever.

Questions About the Mansion Tax Changes?

Whether you’re planning to buy or sell, understanding how the new law impacts your deal is key.

Call us today at 609‑467‑4061 to talk through your options.